Company Tax Preferences

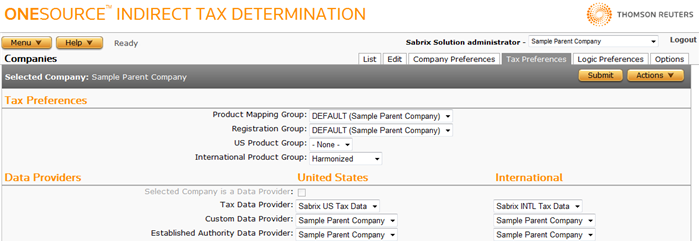

Menu > System > Companies > Tax Preferences

Use this page to configure:

- Default product and registration groups

- Tax data providers

- Company inheritance for custom data, established authority data, and currency exchange data

- European Union One-Stop Shop (OSS) authority elections

This tab is not available when you select a company with a type of Tenant.

Before using this page for the first time, please review Companies.

If you are processing transactions that generally take place only inside or only outside the United States, consider the following:

- If you are processing transactions originating outside the United States, but that sometimes include US Locations (Order Origin, Ship To, and so on), you must specify a US Tax Data Provider. You can:

- Select a Tax Data Provider that has full data (if you want to generate US tax results).

- Create a US Tax Data Provider that only has a single Zone (United States), and then set this company as your US Tax Data Provider. This enables you to process transactions that include the United States, but does not generate US tax results.

- Select your own company as the US Tax Data Provider. If you do this, you also need to change the severity of the message NO_ZONE_TREE_MATCH to 1 (Warning) from 2 (Severe).

- If you are processing transactions that originate inside the United States, but also need the ability to handle transactions involving locations outside the US, you can:

- Select an International Tax Data Provider that has full data (if you want to generate International tax results).

- Select your own company as the International Tax Data Provider. If you do this, you also need to change the severity of the message NO_ZONE_TREE_MATCH to 1 (Warning) from 2 (Severe).

If you need to change the severity of a message, see Edit Application Messages.

Understanding Tax Data Provider Status

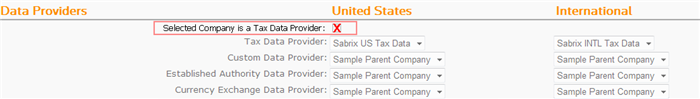

The information shown on the Tax Preferences Data Providers section depends on whether the company is configured as a Tax Data Provider. Before you set or change values in this section, use the Tax Preferences field reference table below to understand required and optional data.

The following example shows the fields when the selected company is not configured as a data provider:

If you select the Selected Company is a Tax Data Provider check box, the Data Providers fields are not available.

Use the Selected Company is a Tax Data Provider check box option with caution. Changing tax data providers can cause you to lose custom data, such as product mappings and custom rules. If data will be lost, Determination prompts you twice to accept the change.

Managing Tax Preferences

Use the field reference tables below to enter required and optional data in the following procedures.

Set company preferences

- Select the desired options using the field reference tables below. The choices are limited depending on both parent/child relationships and whether or not the company you are modifying is a tax data provider.

- Click Submit to save your changes.

Change company preferences

Use this procedure with caution. Consider the results:

- Changing tax data or custom data providers can create large differences in how custom products, product mappings, and tax calculations are handled.

- Carefully review the warning messages displayed while changing providers to understand the results.

- You may need to re-create custom rules, rates, products, and product mappings after you change providers.

- Select the desired options using the field reference tables below.

- Click Submit to save your changes.

Export a company

You can export the selected company, or the company and all of its children. You cannot export the Administration company.

- Select Properties from the Actions menu.

- Click one of the following:

- This Company to export the selected company and all of its child companies.

- This Company Without Children to export only the selected company.

- Click Save.

- Browse to or enter a file name to save to and click Save.

Once you save the file, you can re-import it. See the Importing Data page.

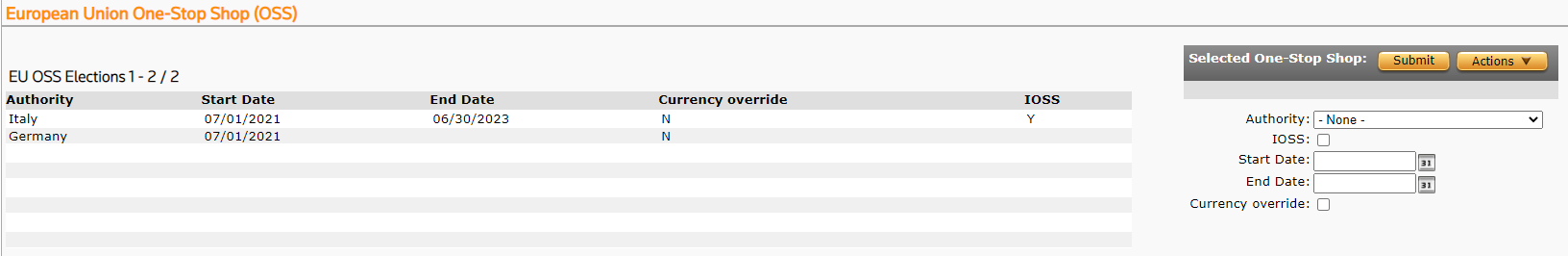

Set EU One-Stop Shop Authority

Use the European Union One-Stop Shop (OSS) section on the Tax Preference page to specify the authority you want to use for One-Stop Shop. For Low Value Goods transactions the Import One-Stop Shop (IOSS) setting is required that can be specified here by selecting IOSS check box.

| Tax Preferences Field Reference | ||

|---|---|---|

| Field | Req? | Description |

| Product Mapping Group |

Y |

Enables you to activate one of your product mapping groups (used to map your source system product codes to Determination product exceptions). Do not select a parent company's Product Mapping Group unless both companies (this company and the parent company) share the same Tax Data Provider and Custom Data Provider. Failing to do so can lead to unexpected results when performing a product lookup during calculation. The default setting is Company Name. |

|

Registration Group |

Y |

Enables you to activate one of your registration groups (used in international tax calculations). Choices are all registration groups owned by this company or those owned by any of its ancestors that use the same tax data provider. The default setting is Company Name. |

| US Product Group | Y | See Product Groups in Products for more information. The default setting is None. |

| International Product Group | Y |

Specifies the International Product Group used by this company. The default setting is None. See Product Groups in Products for more information. |

| Data Providers Field Reference | ||

|---|---|---|

| Field | Req? | Description |

| Selected Company Is a Tax Data Provider | Opt. |

Check this box if your company is a tax data provider. Only top-level companies (directly beneath Administration in the Companies hierarchy) can make this selection. When checked, all other data provider selectors are deactivated. A single company cannot serve as both the International and US tax data provider. You must configure two distinct companies. |

| If Selected Company Is Not a Tax Data Provider | ||

| Tax Data Provider | Y |

The Determination company providing your tax content. Choices are all companies serving as tax data providers. The default setting is None. |

| Custom Data Provide | Y |

The Determination company providing your custom product exceptions. The default setting is Company. Choices are this company and all of its ancestors that use the same tax data provider. For more information, see: |

| Established Authority Data Provider | Y |

Enables you to share established authority configuration for authorities with a parent company that uses the same tax data provider. Choices are this company and all of its ancestors that use the same tax data provider. The default setting is Company. |

| Currency Exchange Data Provider | Y |

Enables you to share exchange rate configuration with a parent company. Choices are this company and all of its ancestors. The default setting is Company. |

| If Selected Company Is a Tax Data Provider | ||

| Tax Data Type | Y | The data type: United States Tax Data (default) or International Tax Data. |

| Tax Data Version | Opt. | Text entry field. |

| Comments | Opt. | Text entry field. |

| European Union One-Stop Shop (OSS) Field Reference | ||

|---|---|---|

| Field | Req? | Description |

| Authority | Y |

Specify the authority you want to use for One-Stop Shop. The authority you elect will be audited as the filing authority for all transactions in EU countries in which you are not registered during the period you specify. |

| IOSS | N | Import One-Stop Shop (IOSS) is the setting that applies to Low Value Goods (LV) transactions only. For this logic to apply to LV transactions, the Authorities must be set and the IOSS checkbox needs to be checked. |

| Start Date | Y |

The date (MM/DD/YYYY) on which the OSS authority election becomes active. Make sure your start date selection is in accordance with EU directives for the selected authority. The minimum start date is 07/01/2021 (July 1, 2021). For all B2C, Electronic Services transactions in EU countries between 01/01/2015 and 06/30/2021 the MOSS logic will be applied when OSS is setup here. |

| End Date | N |

The end date (MM/DD/YYYY) for the OSS authority election. If blank, the OSS authority election remains effective indefinitely. Make sure your end date selection is in accordance with EU directives for the selected authority. Please note that the date range for OSS and IOSS authorities can overlap but you cannot add two authorities with the overlapping date ranges for OSS or IOSS. |

| Interstate Taxable Revenue (ITRP) Field Reference | ||

|---|---|---|

| Field | Req? | Description |

|

This section is not a mandatory setup (for non VoIP companies who will not use this setting). Where possible, telecommunications service providers should report to the FCC the amount of total revenues that are intrastate, interstate, and international by using information from their books of account and other internal data reporting systems. However, wireless and VoIP telecommunications providers may rely on traffic studies (which use statistical sampling to estimate the proportion of minutes that are interstate and international) if they are unable to determine their actual revenue ratios. For more detailed information on traffic study reporting, please see the current version of the FCC document titled “Instructions to the Telecommunications Reporting Worksheet, FCC Form 499-A.” |

||

| Percentage | Y | Enter the percentage amount. Field accepts numbers and decimals. |

| Start Date | Y | Start date (MM/DD/YYYY) |

| End Date | N |

End date (MM/DD/YYYY). You can have multiple data items if the dates do not overlap. |